Estimating European Option Price Using Amplitude Estimation

Introduction and background

In Finance models we are often interested in calculating the average of a function of a given probability distribution (\(E[f(x)]\)). The most popular method to estimate the average is Monte Carlo [1] due to its flexibility and ability to generically handle stochastic parameters. Classical Monte Carlo methods, however, generally require extensive computational resources to provide an accurate estimation. By leveraging the laws of quantum mechanics, a quantum computer may provide novel ways to solve computationally intensive financial problems, such as risk management, portfolio optimization, and option pricing. The core quantum advantage of several of these applications is the Amplitude Estimation algorithm [2] which can estimate a parameter with a convergence rate of \(\Omega(1/M^{1/2})\), compared to \(\Omega(1/M)\) in the classical case, where \(M\) is the number of Grover iterations in the quantum case and the number of the Monte Carlo samples in the classical case. This represents a theoretical quadratic speed-up of the quantum method over classical Monte Carlo methods.

Option pricing

An option is the possibility to buy (call) or sell (put) an item (or share) at a known price - the strike price (K), where the option has a maturity price (S). The payoff function to describe for example a European call option will be:

\(f(S)=\ \Bigg\{\begin{array}{lr} 0, & \text{when } K\geq S\\ S - K, & \text{when } K < S\end{array}\)

The maturity price is unknown. Therefore, it is expressed by a price distribution function, which may be any type of a distribution function. For example a log-normal distribution: \(\mathcal{ln}(S)\sim~\mathcal{N}(\mu,\sigma)\), where \(\mathcal{N}(\mu,\sigma)\) is the standard normal distribution with mean equal to \(\mu\) and standard deviation equal to \(\sigma\) .

To estimate the average option price using a quantum computer, one needs to:

-

Load the distribution, that is, discretize the distribution using \(2^n\) points (n is the number of qubits) and truncate it.

-

Implement the payoff function that is equal to zero if \(S\leq{K}\) and increases linearly otherwise. The linear part is approximated in order to be loaded properly using \(R_y\) rotations [3].

-

Evaluate the expected payoff using amplitude estimation.

The algorithmic framework is called Quantum Monte-Carlo Integration. For a basic example, see QMCI. Here we use the same framework to estimate european call option, where the underlying asset distribution at the maturity data is modeled as log-normal distribution.

Designing The Quantum Algorithm

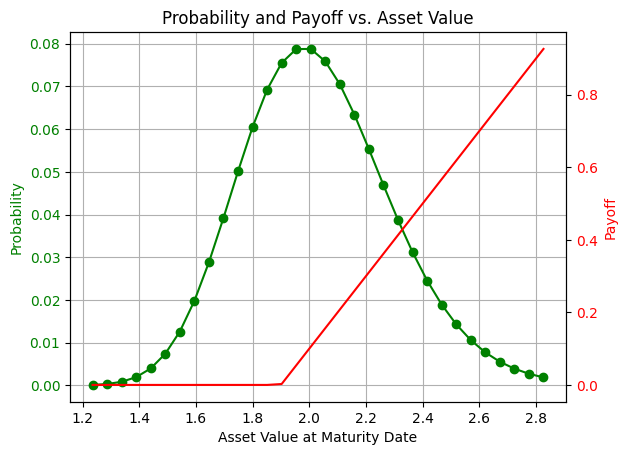

The probability distribution

We begin by creating the probability distribution. The distribution is describing the option underlying asset price at maturity date. We will load a discrete version of the log normal probability with \(2^n\) points, when \(\mu\) is equal to mu, \(\sigma\) is equal to sigma and \(n\) is equal to num_qubits.

We also choose here K, the strike price.

num_qubits = 5

mu = 0.7

sigma = 0.13

K = 1.9

import matplotlib.pyplot as plt

import numpy as np

import scipy

def get_log_normal_probabilities(mu, sigma, num_points):

mean = np.exp(mu + sigma**2 / 2)

variance = (np.exp(sigma**2) - 1) * np.exp(2 * mu + sigma**2)

stddev = np.sqrt(variance)

# cut the distribution 3 sigmas from the mean

low = np.maximum(0, mean - 3 * stddev)

high = mean + 3 * stddev

print(mean, variance, stddev, low, high)

x = np.linspace(low, high, num_points)

return x, scipy.stats.lognorm.pdf(x, s=sigma, scale=np.exp(mu))

grid_points, probs = get_log_normal_probabilities(mu, sigma, 2**num_qubits)

# normalize the probabilities

probs = probs / np.sum(probs)

fig, ax1 = plt.subplots()

# Plot the probabilities

ax1.plot(grid_points, probs, "go-", label="Probability") # Green line with circles

ax1.tick_params(axis="y", labelcolor="g")

ax1.set_xlabel("Asset Value at Maturity Date")

ax1.set_ylabel("Probability", color="g")

# Create a second y-axis for the payoff

ax2 = ax1.twinx()

ax2.plot(grid_points, np.maximum(grid_points - K, 0), "r-", label="Payoff") # Red line

ax2.set_ylabel("Payoff", color="r")

ax2.tick_params(axis="y", labelcolor="r")

# Add grid and title

ax1.grid(True)

plt.title("Probability and Payoff vs. Asset Value")

2.030841014265948 0.07029323208790372 0.26512870853210846 1.2354548886696226 2.8262271398622736

Text(0.5, 1.0, 'Probability and Payoff vs. Asset Value')

Quantum function for the distribution loading

Here we use the general inplace_prepare_state function. The inplace is needed as it needs to be applied over and over again on the same quantum variable.

We use the genreal purpose state preparation for simplicity. There are more efficient and scalable methods for preparing the required distribution, for example see [4].

from classiq import *

@qfunc

def load_distribution(asset: QNum):

inplace_prepare_state(probabilities=probs.tolist(), bound=0, target=asset)

The payoff function

We continue with creating the payoff function . We want to load \(U_{payoff}|S\rangle|0\rangle = \sqrt{f_{payoff}(S)}|S\rangle|1\rangle + \sqrt{1-f_{payoff}(S)}|S\rangle|0\rangle\).

Here, to build the European call option function, we will do nothing if the strike price is smaller than \(K\), otherwise we apply a linear amplitude loading.

Note: in order to save qubits and depth, the register \(|S\rangle_n\) will hold a value in the range \([0, 2^{n-1}]\), "labeling" the asset value. The mapping to the asset value space will occur within the comparator and amplitude loading, using the the following (classical) scale function

from classiq.qmod.symbolic import ceiling

grid_step = (max(grid_points) - min(grid_points)) / (len(grid_points) - 1)

# translate from qubit space to price space

def scale(val: QNum):

return val * grid_step + min(grid_points)

# translate from price space to qubit space

def descale(val: int):

return (val - min(grid_points)) / grid_step

@qfunc

def payoff(asset: Const[QNum], ind: QBit):

aux = QBit()

# check if asset price is 'in the money' - crossed the strike price

within_apply(

lambda: assign(asset >= ceiling(descale(K)), aux),

lambda: payoff_linear(asset, ind),

)

Here, for simplicity, we use a general purpose amplitude loading method using the *= syntax. The calculation is exact, however not scalable for large variable sizes.

There are more scalable methods, like the ones mentioned in [4], [6].

Important: In order that all loaded amplitudes will not be greater than 1, we have to normalize the payoff by scaling_factor, later to be multiplied in the post-process stage.

from classiq.qmod.symbolic import abs, sqrt

scaling_factor = max(grid_points) - K

@qfunc

def payoff_linear(asset: Const[QNum], ind: QBit):

ind *= sqrt(abs((scale(asset) - K) / scaling_factor))

@qfunc

def european_call_state_preparation(asset: QNum, ind: QBit):

load_distribution(asset)

payoff(asset, ind)

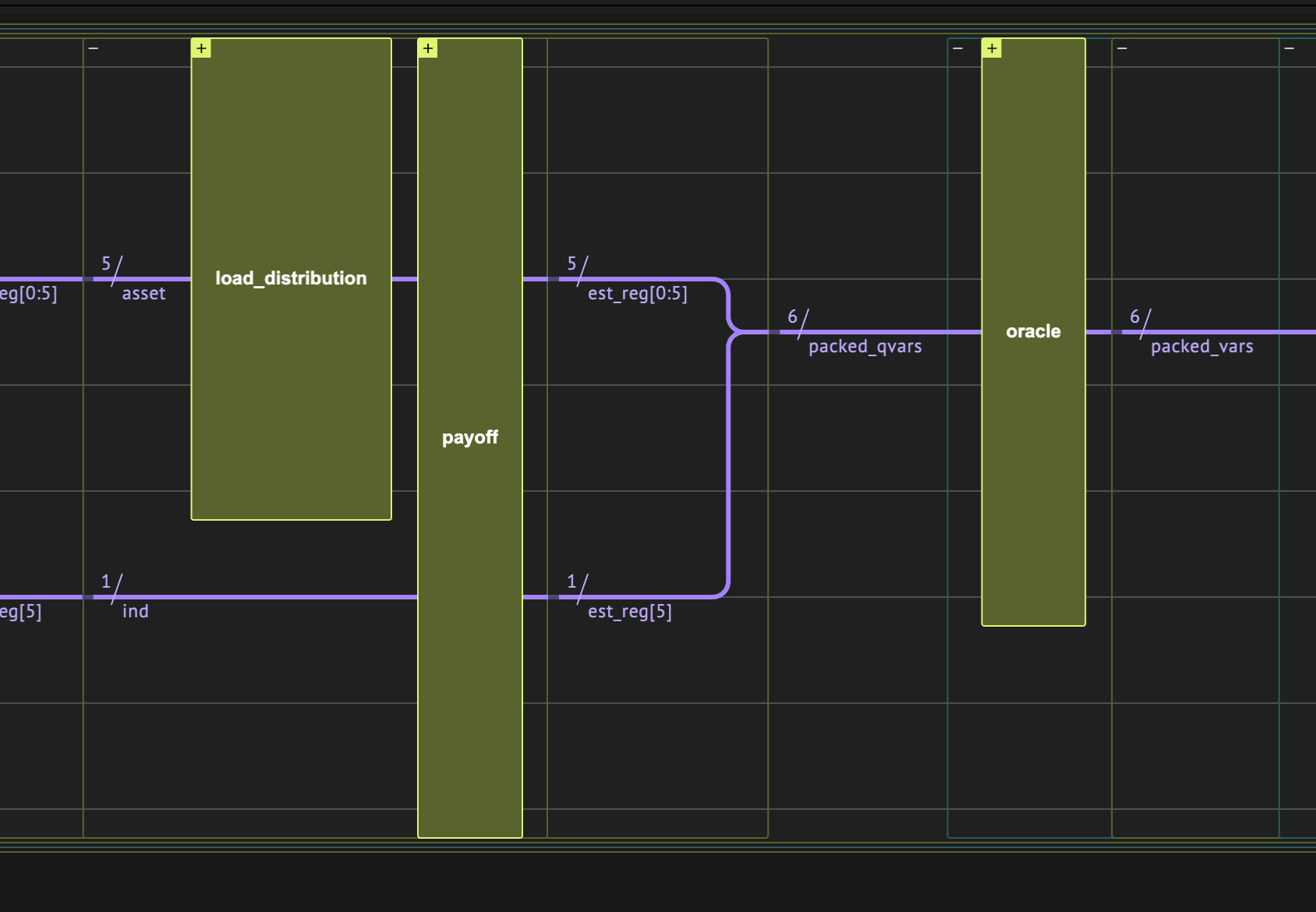

Wrapping to an Amplitude Estimation model

After defining the probability distribution and the payoff function, we pack them together as a state-preparation in the Iterative Quantum Amplitude Estimation algorithm [5]. The oracle is very simple and will only need to recognize whether the indicator qubit is in the \(|1\rangle\) state.

The returned amplitude from the algorithm is according to the formula:

Which approximates the expectation value of the payoff:

The IQAE is a built-in application expects a state-preparation operand, and builds a model for the iterative amplitude estimation algorithm.

from classiq.applications.iqae.iqae import IQAE

iqae = IQAE(

state_prep_op=european_call_state_preparation,

problem_vars_size=num_qubits,

constraints=Constraints(max_width=20),

preferences=Preferences(optimization_level=1),

)

Quantum program synthesis

After we finished the model design, we synthesize the model to a quantum program.

qmod = iqae.get_model()

write_qmod(qmod, "option_pricing", decimal_precision=10)

qprog = iqae.get_qprog()

show(qprog)

Quantum program link: https://platform.classiq.io/circuit/2yic7srm3BIojktRmE5wtlmDJ3E

Quantum Program Execution

We define the parameters for the accuracy of the amplitude estimation. This will affect the expected number of grover of repetitions within the execution:

result_iqae = iqae.run(

epsilon=0.05, alpha=0.01 # desired error # desired probability for error

)

Post processing

In order to get the expected payoff, we need to descale the measured amplitude by scaling_factor.

measured_payoff = result_iqae.estimation * scaling_factor

confidence_interval = np.array(result_iqae.confidence_interval) * scaling_factor

print("Measured Payoff:", measured_payoff)

print("Confidence Interval:", confidence_interval)

Measured Payoff: 0.2175367452508563

Confidence Interval: [0.18093319 0.2541403 ]

Compare to the expected calculated payoff

expected_payoff = sum((grid_points - K) * (grid_points >= K) * probs)

print("Expected Payoff:", expected_payoff)

Expected Payoff: 0.17680663493930157

assert np.isclose(

measured_payoff,

expected_payoff,

atol=10 * (confidence_interval[1] - confidence_interval[0]),

)

References

[1]: Paul Glasserman, Monte Carlo Methods in Financial Engineering. Springer-Verlag New York, 2003, p. 596.

[2]: Gilles Brassard, Peter Hoyer, Michele Mosca, and Alain Tapp, Quantum Amplitude Amplification and Estimation. Contemporary Mathematics 305 (2002)

[3]: Nikitas Stamatopoulos, Daniel J. Egger, Yue Sun, Christa Zoufal, Raban Iten, Ning Shen, and Stefan Woerner, Option Pricing using Quantum Computers, Quantum 4, 291 (2020).

[4]: Chakrabarti, Shouvanik, et al. "A threshold for quantum advantage in derivative pricing." Quantum 5 (2021): 463.

[5]: Grinko, D., Gacon, J., Zoufal, C. et al. Iterative quantum amplitude estimation. npj Quantum Inf 7, 52 (2021)

[6]: Francesca Cibrario et al., Quantum Amplitude Loading for Rainbow Options Pricing. Preprint